Quickbooks Payroll

Payroll service that goes beyond a paycheck

With #1 online Payroll Provider you can pay your team and access benefits and HR.

With #1 online Payroll Provider you can pay your team and access benefits and HR.

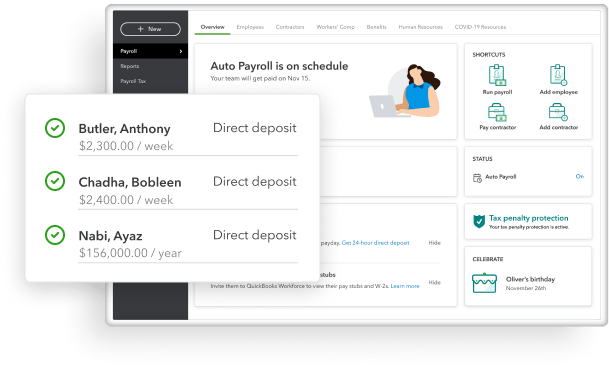

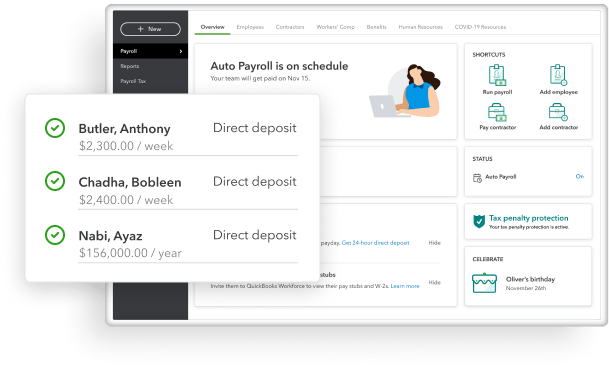

You can focus on your day-to-day activity of business by setting payroll to run automatically and managing all the work in Quickbooks.

Quickbooks will calculate your files and also pay your payroll taxes.

With a same-day direct deposit, we'll hold on to your money longer.

You can also manage employees and HR benefits from your account.

You can access integrated employee services, approve payroll when you’re ready and manage every task related to your business accounts in one place.

If you make an error in Quickbooks Payroll, then we’ll pay up to $25,000 as a tax penalty.

You can create invoices, approve timesheets, pay your team on the go.

Your payroll helps you to pay your team on your schedule and can hold on to your cash for longer.

If you set your payroll to run automatically then it will free up most of your time.

We’ll calculate your files and then pay your state and federal taxes for you.

Our experts can also complete and review your setup. You can start a chat or call an expert whenever required.

Explore all the employee services you can get with QuickBooks Payroll

You can stay complaint by talking to our HR advisor or access helpful resources with us.

Get advanced coverage for on-the-job injuries and save your money with the AP Intego policy.

We also offer dental, vision, and medical insurance packages through which you and your employees get simply insured.

By synchrony with Quickbooks Payroll, you can access affordable retirement plans by Guidelines.

We provide you best support that you and your team need the most. We'll answer your question, help you in setting up your account, and provide tax-time coverage that you can't get anywhere else.

Ans. Quickbooks Online Payroll works for small to midsize businesses. It works in various aspects of business such as from financial experts and Accountants to non-profits, restaurants, and construction companies as well.

Ans. There is generally 3 payroll plan in which you can switch as per your choice – Elite, Core, and Premium.

In the Core payroll plan, you can have your payroll taxes done for you and can pay your team easily. In the Elite payroll plan, you can simplify the protection and per day what matters to you the most, with having access to on-demand experts.

In the Premium payroll plan, you can access your employees and HR benefits by easily managing your team.

Ans. You can share valuable insights and export, print, run or customize a payroll report with your accountant. However, payroll reports cover the following tasks - payroll deduction and contribution, multiple websites, payroll tax, and wage summary, payroll tax liability, vacation, and sick leaves, worker's compensation, and time activities.

Ans. If you transfer your payroll data to another payroll provider then we'll manage to transfer your data with our Quickbooks Payroll Elite for you.

Ans. Yes, Of course. Our Payroll experts will guide you through the payroll setup and help you to stay compliant.

Ans. You can choose the plan that works for you and your team, no matter that you have one or more employees in your business.