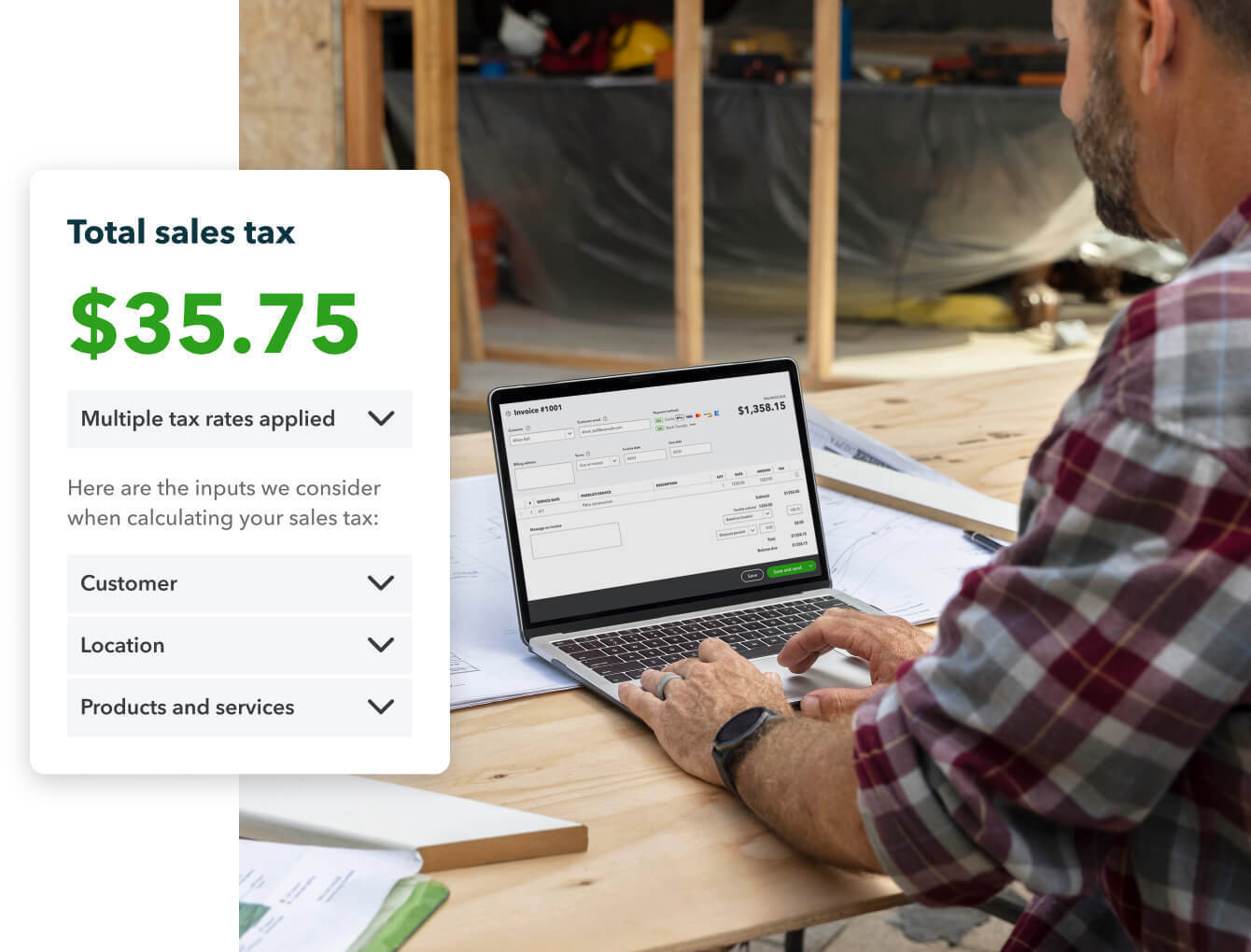

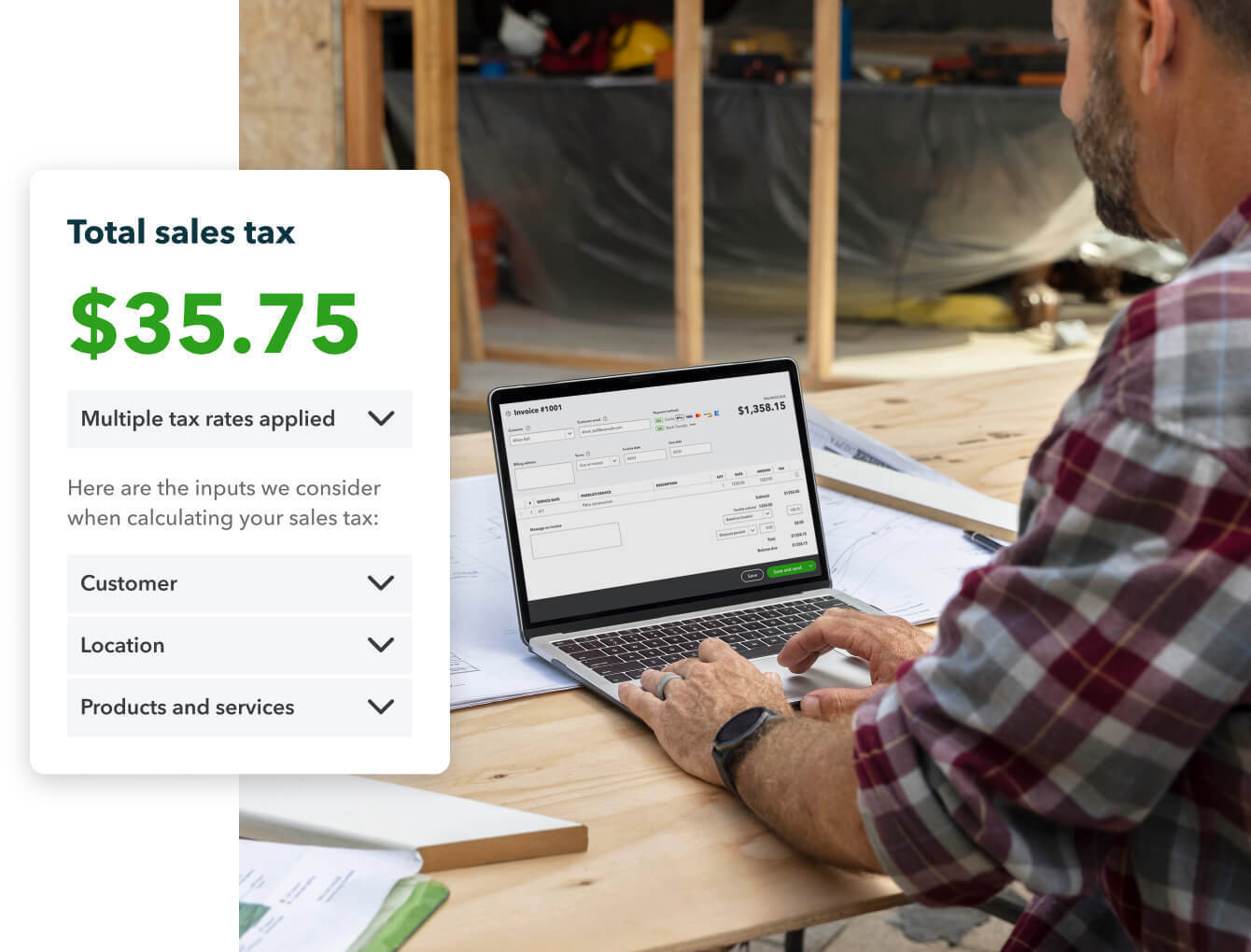

The calculations will automatically take care of you when you add sale tax to invoices in Quickbooks Online. We calculate the sale tax rate depending on its location, date, customers, types of products, and services.

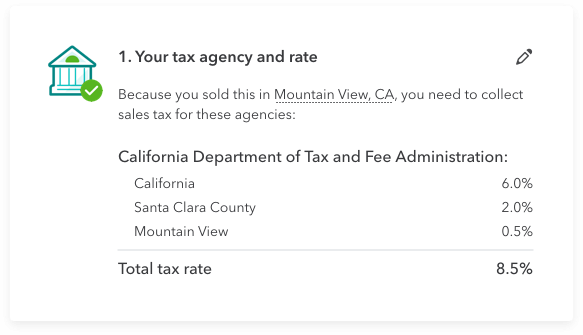

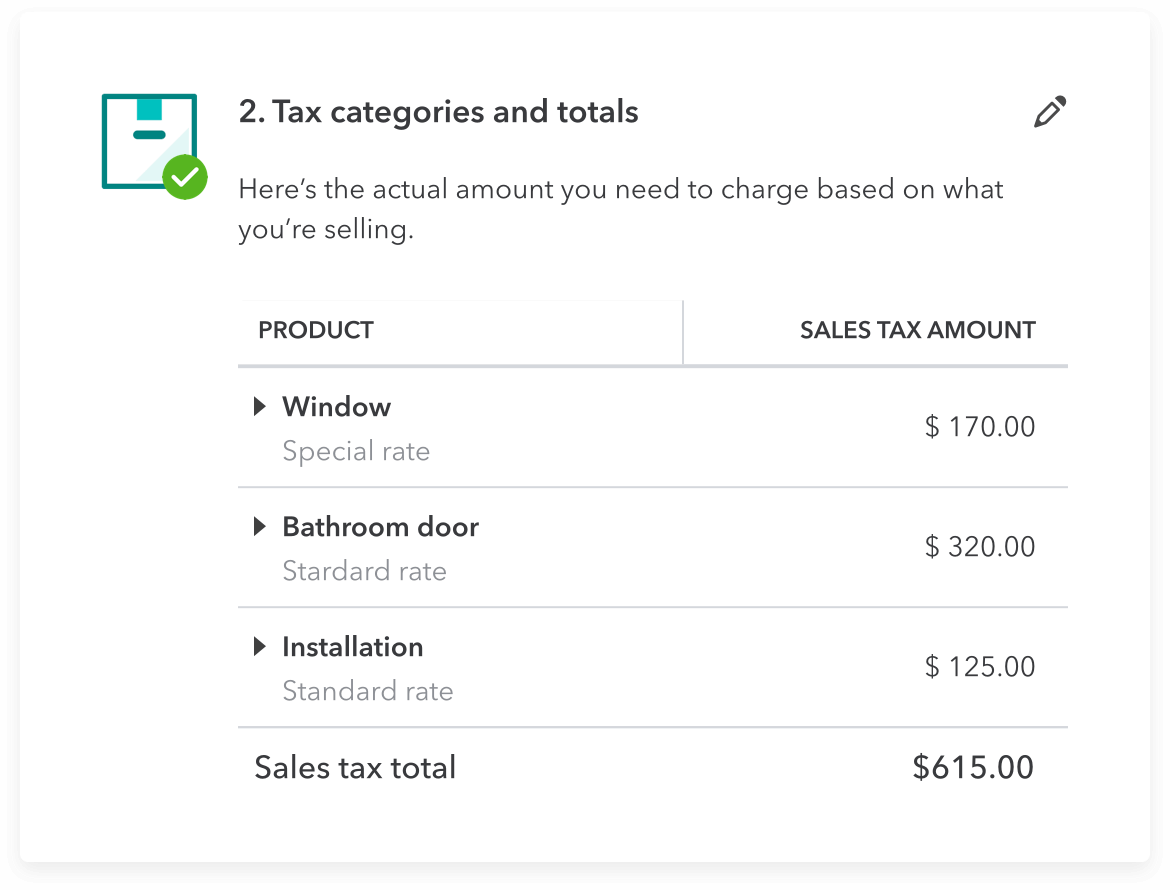

The rules are changes from state to state for how to tax a product. Quickbooks will assure you that the correct rate is applied to your transaction-based business on the location of sale you indicate and the category of products after your products are being categorized.

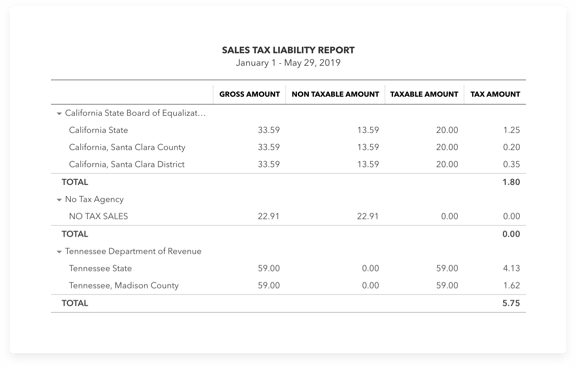

With the Sales Tax Liability Report of Quickbooks, you can view the information of your sales anytime. These on-demand reports on your taxable and non-taxable sales will keep you up-to-date and are broken down by tax agency.

Ans. It is a tax that is paid to the tax authority for the sale of goods and services. Sales tax depending on its state can be referred to as excise, privileges taxes, or retail. Sales tax is collected by the sellers and is paid by the buyers. However, the seller has the obligation to remit the sales tax within a prescribed period to the proper tax agency.

Ans. Sales tax is provided to the local or state government with funds for public service. Some examples include maintenance and infrastructure of buildings (government-owned buildings, parks, roads, etc).

Ans. Sales tax is imposed in all the states. As a buyer, if any seller does not charge any sales tax to you then only you're not required to pay the sales tax. However, as a seller, if you fail to pay or collect sales tax and the tax authorities determine it then they will assess penalties and interest. They can put liens on your assets or put them away which can also have a negative impact on your credits.

Ans. There are 45 states and the District of Colombia to collect sales tax required that is by the businesses. If you are selling any goods or services in one of these states then you're responsible for collecting, calculating, and paying sales tax. As every state has its rates of sales tax and sets of laws and the different countries, cities, and districts may have their own sales tax requirement.