Track mileage automatically

Mileage can be one of the largest tax deductions for a small business. No matters whether you're driving full-time or part-time or making delivery occasionally.

Mileage can be one of the largest tax deductions for a small business. No matters whether you're driving full-time or part-time or making delivery occasionally.

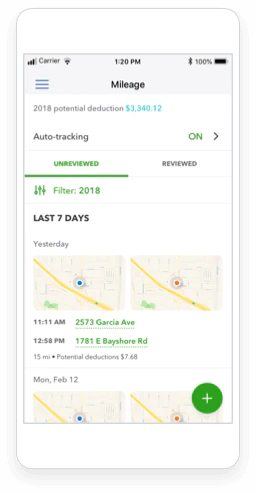

Just drive as it is easier than doing nothing and Quickbooks will use your phone location to detect when you’re driving. You can also add a trip manually in Quickbooks Online.

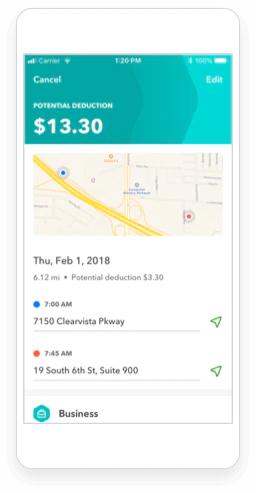

You can easily categorize an individual's trip as personal or business to rack up potential tax deductions accurately.

You can easily see the potential deduction and breakdown of miles. Moreover, it is simple to share whenever required.

As your business grows, you can transfer your current mileage automatically to Quickbook Online from Quickbooks Self-Employed.

Ans. You can easily add a manual trip right from your phone in the following steps.

Ans. Yes, you can easily share every tax detail with your accountant such as mileage reports, mileage, etc. Quickbooks provides the list of the total amount of each schedule C deduction category and the self-assigned taxable profit of your business.

Ans. You can easily track miles in Quickbooks Self-Employed and Quickbooks Online.

Ans. You can automatically transfer your Current Mileage from Quickbooks Self-Employed to Quickbooks Online. You can also select the option to bring your data over after you switch plans or sign in to Quickbooks. You’ll easily find your miles in your new account.